If you’re self-employed and use your car, SUV or other vehicle for business, you can deduct certain business-related vehicle expenses. Depending on the cost of operating the vehicle or how much you drive it, as well as how much of your use of the vehicle is for business purposes, this can add up to a significant tax deduction.

Continue readingTax Breaks for Teachers and Other Educators

It’s almost time for the start of the new school year, and if you are a teacher or other educator, you should know that you can still deduct certain unreimbursed expenses.

Continue readingCPAmerica NextGen Conference 2023

In July, Wheeler sent a few members of the supervisor and manager group to attend the CPAmerica Next Generation (NextGen) Conference in San Diego. The Conference is designed for CPAmerica members’ seniors through managers who want to gain a better understanding of how the public accounting business works.

As first year attendees, our staff were part of the Intermediate Track. They were immersed in relationship building, leadership principles, and practice management basics with other professionals at their level, along with partners and presenters committed to developing “career coachable” employees.

One of the favorite sessions was the partner panel in which partners from three different firms across the country discussed life as a partner, the expectations and responsibilities, and the process it took to become a partner at their firms. It was an eventful three days in San Diego’s perfect weather for our staff and unfortunately they returned to an extremely hot weekend of 97 degrees back in San Jose!

AB 152 Extends SPSL and Offers Relief

What is AB 152? Let us fill you in.

On September 29, 2022, CA Governor Gavin Newsom signed into law AB 152 which extended the Covid-19 Supplemental Paid Sick Leave (SPSL) program until 12/31/22. This program requires employers with 26 or more employees to continue to pay sick leave to employees out of work due to Covid-19 if they had not previously exhausted their SPSL entitlements before December 31, 2022.

This bill also established the CA Small Business and Nonprofit Covid-19 Relief Grant to assist qualified small businesses or nonprofits that are incurring costs for SPSL. The grant provides relief up to $50,000. The total amount an applicant can request under the program shall be no more than the actual costs incurred for SPSL provided from 1/1/22-12/31/22.

A qualifying business meets the following criteria:

- Began operating before 6/1/2021

- Is registered as a C or S corporation, cooperative, LLC, partnership, LP, or a registered 501(c)(3), 501(c)(6), or 501(c)(19) entity

- Must be an active and operating business

- Employs 26-49 employees (SPSL was not required for Employers with less than 26 employees)

- To determine if this requirement has been met, calculate the number of full-time employees that have worked for the employer, without any break in employment, for 24 months between January 1, 2021 – December 31, 2022.

- Has been providing SPSL to eligible employees as required by law

- Provides the documentation listed below under Documents Needed

Documents needed:

- Payroll records that show Covid-19 SPSL, pursuant to Sections 248.6 and 248.7, was paid from 1/1/22-12/31/22

- Signed affidavit attesting employee count

- Organizing documents including official filings with the CA SOS (Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration, or Government issued business license)

- A copy of the 2020 or 2021 tax return (for profit) or Form 990 (nonprofit)

- Forms W-2s for 2021 & 2022

- Proof of Tax-Exempt status if applicable (Copy of IRS exemption determination letter).

- Acceptable government-issued Photo ID of representative submitting application

- Valid bank account linked via Plaid, or two most recent months of bank statements with transaction history

How to apply:

The application process is found here:

The application window is currently closed. There is an option to enter your contact information to be notified when the next window will be open, and we recommend that you do this if you are eligible for the grant. Fill out the Notification Form below:

What is CA Covid Sick Pay (SPSL)?

Passed in February 2022, entitles Full-Time employees up to 80 hours of paid leave related to two banks. Bank One (40 hours) – Isolation, Vaccines, Childcare. Bank Two (40 hours) – Positive Cases of Covid. CA employers can require Covid-19 tests of a diagnosis and can refuse paid sick leave to employees who won’t comply with required tests.

Businesses & Organizations that are NOT eligible:

- Businesses and nonprofits that do not operate or have physical presence in CA

- Government entities except Native American tribes

- Organizations with political or lobbying activity

- Passive businesses, investment companies, and investors who file a Schedule E

- Financial institutions

- Businesses engaged in any activity that is unlawful under federal, state, or local law

- Businesses that have customer restrictions for any reason except the capacity

- Speculative businesses

- Companies with an owner who has 10% equity interest and that owner has been convicted of a crime within 3 years or if they are currently indicted

If you have any questions, don’t hesitate to reach out to your preparer.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

Small Business Financing: Securing a Loan

At some point, most small business owners will visit a bank or other lending institution to borrow money. Understanding what your bank wants and how to approach it properly can mean the difference between getting a loan for expansion or scrambling to find cash from other sources.

Understand the Basic Principles of Banking

It is vital to present yourself as a trustworthy businessperson, dependable enough to repay borrowed money, and to demonstrate that you understand the basic principles of banking. Your chances of receiving a loan will greatly improve if you can see your proposal through a banker’s eyes and appreciate the position that the bank is coming from.

Banks are responsible to government regulators, depositors, and the community in which they reside. While a bank’s cautious perspective may irritate a small business owner, it is necessary to keep the depositors’ money safe, the banking regulators happy, and the community’s economy healthy.

Each Bank Is Different

While banks in general have a cautious attitude toward lending, they differ in the types of financing they make available, interest rates charged, willingness to accept risk, staff expertise, services offered, and attitude toward small business loans.

Selection of a bank is essentially limited to your choices from the local community. Typically, banks outside of your area will be more reluctant to make loans to you because of the higher costs of checking credit and of collecting the loan in the event of default.

Furthermore, a bank will typically not make loans, regardless of business size, unless a checking account or money market account is maintained at that institution. Ultimately your task is to find a business-oriented bank that will provide the financial assistance, expertise, and services your business requires now and is likely to require in the future.

Building Rapport

Establishing a favorable climate for a loan request should begin long before the funds are needed. The worst possible time to approach a new bank about a loan is when your business is in the throes of a financial crisis. Devote time and effort to building a relationship and goodwill with the bank you choose and early on get to know the loan officer you will be dealing with.

Bankers’ overriding concern generally is minimizing risk. Logic dictates that this is best accomplished by limiting loans to businesses they know and trust. One way to build rapport and establish trust is to take out small loans, repay them on schedule, and meet all loan agreement requirements in both letter and spirit. By doing so, you gain the banker’s trust and loyalty, and the banker will consider your business a valued customer and make it easier for you to obtain future financing.

Provide the Information Your Banker Needs

Lending is the essence of the banking business, and making mutually beneficial loans is as important to the bank’s success as it is to the small business. This means that understanding what information a loan officer seeks and providing the evidence required to ease normal banking concerns is the most effective approach to getting the financing you desire.

A sound loan proposal should contain information that expands on the following points:

- What is the specific purpose of the loan?

- How much money is required?

- What is the source of repayment for the loan?

- What evidence is available to substantiate the assumptions that the expected source of repayment is reliable?

- What alternative source of repayment is available if management’s plans fail?

- What business or personal assets, or both, are available to collateralize the loan?

- What evidence is available to substantiate the competence and ability of the management team?

You need to do your homework before making a loan request because an experienced loan officer will ask probing questions about each of these items. Failure to anticipate such questions or providing unacceptable answers is damaging evidence that you may not completely understand your business and are incapable of planning for its needs.

What To Do Before You Apply for a Loan

1. Write a business plan. Your loan request should be based on and accompanied by a complete business plan. This document is the single most important planning activity you can perform. A business plan is more than a device for getting financing; it is the vehicle that makes you examine, evaluate, and plan for all aspects of your business. A business plan’s existence proves to your banker that you are doing all the right activities. Once you have put the plan together, write a two-page executive summary. You will need it if asked to send “a quick write-up.”

2. Have an accountant prepare historical financial statements. You cannot discuss the future without accounting for your past. Internally generated statements are OK, but your bank wants the comfort of knowing an independent expert has verified the information. Also, you must understand your statement and be able to explain how your operation works and how your finances stand up to industry norms and standards.

3. Line up references. Your banker may want to talk to your suppliers, customers, potential partners, or team of professionals. When a loan officer asks for permission to contact references, promptly answer with names and contact information; do not leave the officer waiting for a week.

Walking into a bank and talking to a loan officer will always be stressful. Preparation for and thorough understanding of this evaluation process is essential to minimize the stressful variables and optimize your potential to qualify for the funding you seek.

Seek Advice From a Tax Professional

The advice and experience of a tax and accounting professional are invaluable. Do not be shy about calling the office.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

Verifying Your Identity When Calling the IRS

Sometimes, taxpayers must call the IRS about a tax matter. As part of the IRS’s ongoing efforts to keep taxpayer data secure from identity thieves, IRS phone assistors take great care to discuss personal information with the taxpayer or someone the taxpayer has authorized to speak on their behalf. Therefore, the IRS will ask taxpayers and their representatives to verify their identity when they call.

Calling the IRS About Your Own Tax Matter

You should have the following information ready before calling the IRS:

- Social Security numbers (SSNs) and birth dates for those who were named on the tax return

- An Individual Taxpayer Identification Number (ITIN) letter if you have one instead of an SSN

- Your filing status: single, head of household, married filing jointly, or married filing separately

- Your prior-year tax return, because phone assistors may need it to verify taxpayer identity with information from the return before answering certain questions

- A copy of the tax return in question

- Any IRS letters or notices you have received

Legally Designated Representatives

By law, IRS telephone assistors will speak only with the taxpayer or to the taxpayer’s legally designated representative. In other words, a taxpayer can grant authorization to a third party to help with federal tax matters. Depending on the authorization, the third party can be a family member, friend, tax professional, attorney, or business. The different types of third-party authorizations include:

- Power of Attorney – Allow someone to represent you in tax matters before the IRS. This is different from a power of attorney for property who you authorize to manage your financial affairs. It must be an individual authorized to practice before the IRS.

- Tax Information Authorization – Appoint anyone to review and receive your confidential tax information for the type of tax and years/periods you determine.

- Third Party Designee – Designate a person on your tax form to discuss that specific tax return and year with the IRS.

- Oral Disclosure – Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with the IRS about a specific tax issue.

Note: Taxpayers must meet all of their tax obligations even when authorizing someone to represent them.

Calling on Behalf of Someone Else

If you are calling the IRS about someone else’s account, you should be prepared to verify your identity and provide information about the person you represent. Before calling about a third party, you should have the following information available:

- Verbal or written authorization from the taxpayer to discuss the account

- The ability to verify the taxpayer’s name, SSN or ITIN, tax period, and tax forms filed

- Identity Protection PIN (IP PIN)

- One of these forms, which is current, completed, and signed: Form 8821, Tax Information Authorization or Form 2848, Power of Attorney and Declaration of Representative

Keep in mind that if your tax professional is calling the IRS on your behalf, your tax pro will need to have this information about you, except generally a Preparer Tax Identification Number (PTIN) instead of an IP PIN.

Questions or Concerns?

If you have any questions or concerns about verifying your identity before calling the IRS, do not hesitate to contact the office for assistance.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

Kids’ Day Camp Expenses May Qualify for a Tax Credit

Day camps are common during school vacations and the summer months. And their cost may count towards the child and dependent care credit.

Here are five things parents should know:

1. Care for Qualifying Persons: You may qualify for the credit whether you pay for care at home, at a daycare facility, or a day camp. Your expenses must be for the care of one or more qualifying persons, such as your dependent child under age 13.

2. Work-Related Expense: In other words, you must be paying for the care so you can work or look for work.

3. Expense Limits: The total expense you can claim in a year is limited. The limit is generally $3,000 for one qualifying person or $6,000 for two or more.

4. Credit Amount: The credit is worth between 20 and 35 percent of your allowable expenses. The percentage depends on your income.

5. Excluded Care: Certain types of care don’t qualify for the credit, including:

- Overnight camps,

- Summer school tutoring,

- Care provided by your spouse or child under age 19 at the end of the year, and

- Care given by a person you can claim as your dependent.

Remember that this credit is not just a school vacation or summer tax benefit. You may be able to claim it at any time during the year for qualifying care. For more information, please call the office.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

Filing a Final Tax Return for a Deceased Person

When someone dies, their surviving spouse or representative must file a final tax return for the deceased person. Usually, the representative is named in the person’s will or appointed by a court. Sometimes when there isn’t a surviving spouse or appointed representative, a personal representative will file the final return.

The IRS doesn’t need any notification of the death other than noting the death on the final tax return, but there are three things taxpayers should know about filing the final return:

- The surviving spouse generally is eligible to use the married filing jointly or married filing separately filing status when filing the return.

- The final return is due by the regular April tax date unless the surviving spouse or representative files an extension.

- Surviving spouses with dependent children may be able to file as a Qualifying Widow(er) for two years after their spouse’s death. This filing status allows them to use joint filer tax rate schedules (which can be beneficial, depending on income level) and, if they don’t itemize deductions, claim the highest standard deduction amount.

Questions?

Don’t hesitate to call if you have any questions about filing a final tax return for someone who has passed away.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

Tips for Taxpayers With Hobby Income

Hobby activities are a source of income for many taxpayers. As a reminder, this income must be reported on tax returns. But the reporting rules are different than for income from a for-profit business. For one thing, hobbyists can’t deduct their hobby expenses.

A hobby is any activity that a person pursues because they enjoy it without intending to make a profit. When determining whether your activity is a business or hobby, consider the following nine factors:

- Whether the activity is carried out in a business-like manner and you maintain complete and accurate books and records.

- Whether your time and effort in the activity show you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether any losses are due to circumstances beyond your control or are normal for the startup phase of their business.

- Whether you change methods of operation to improve profitability.

- Whether you and your advisors know how to conduct the activity as a successful business.

- Whether you successfully made a profit from similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity.

No one factor is more important than another. If you receive income from an activity carried on with no intention of making a profit, the income must be reported on Schedule 1, Form 1040. Please contact the office if you have any questions about hobby income.

San Jose: (408) 252-1800

Watsonville: (831) 726-8500

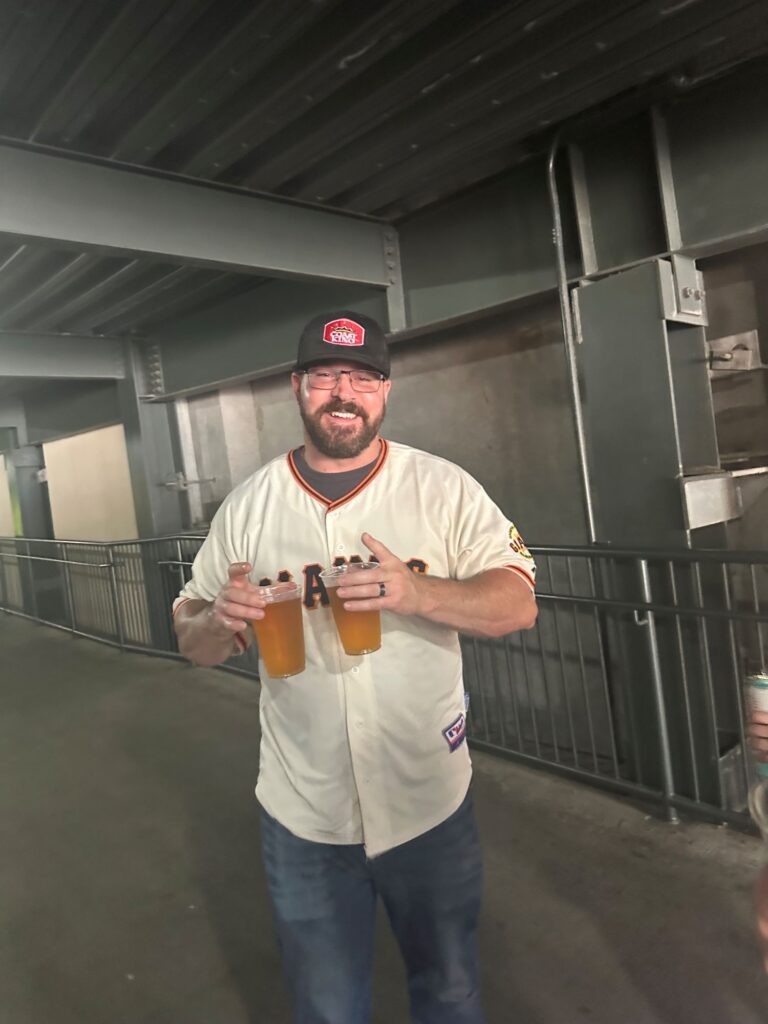

Wheeler Giants Game 2023

Honoring our FAVORITE summer tradition, the Wheeler team took Caltrain up to San Francisco for a Giants game this month. Come along for the ride:

Thanks Giants! See you next year!